Experiment #14: Financial Planning

It's a bit unfair for me to write this up, because it's very much a self-experiment I have been conducting for most of my life and will be until I decide I have enough reserves to hide away in the woods indefinitely. I also feel like I should add a disclaimer - this isn't professional advice, this isn't even necessarily right, but these are some things I think people (re: Millennials) should be aware of.

Firstly, have you heard of a Roth IRA? You haven't? OK - let's talk. A Roth IRA is a self-supported retirement fund of sorts. Here are the rules:

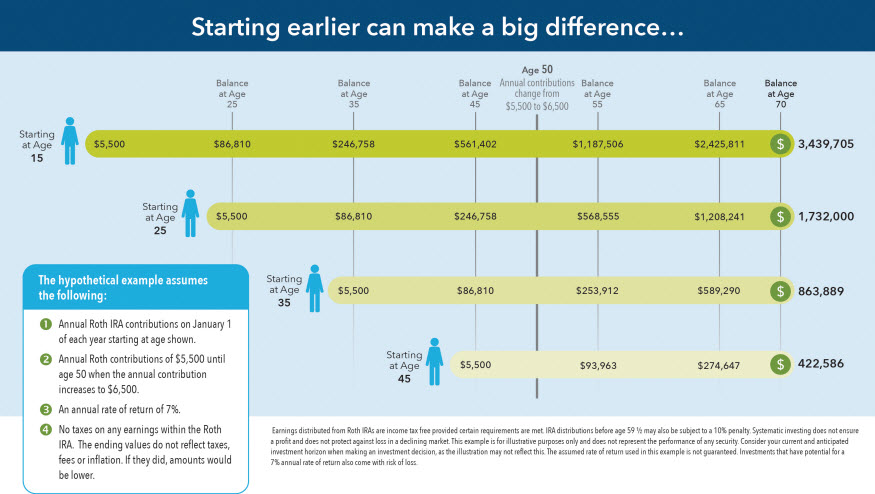

(1) You can *only* put in up to $5500 a year while you are under the age of 50

(2) it is not tax deductible - if you want tax deductible, the Roth IRA's sibling is the Traditional IRA (same limits, but acts more like a 401k)

(3) You take an income tax penalty if you withdraw before you are 65, with some exceptions (like buying a new house).

You need to start now because you can't retroactively fill your IRAs when you have that 'good job'. Oh, and remember, you're going to be taxed more when you have that good job anyway.

|

| Reproduced from Fidelity.com - check out that retirement nest egg! |

Don't worry those weren't the positives, just the rules! Roth IRA's are amazing because of compound interest. If you invest in the Fortune 500 companies (see https://investor.vanguard.com/corporate-portal/ -- my favorite part about Vanguard as an investment profile is that it started as someone's dissertation), you'll see an average growth (based on past years) of 5-10% a year. Remember, inflation is 2% (approximately) and your savings account in your bank is giving you like 0.5%. You are losing money by not investing in the stock market and keeping money in the bank. But really. Scared of "losing it all" in the stock market? First off, you can take capital losses off your taxes so you at least have that security if things go super South. Also, if the stock market collapses, your dollars in your savings account aren't going to be worth a whole lot either. Try it out, invest a little.

|

| Seriously, you gotta start somewhere. Reproduced from pinterest |

I know that seems far off and in the distance (retirement...) but if you need a short term goal, think of your Roth IRA as a nice chunk of savings you can fall back on in the future, whether it is medical, car, or house expenses. As someone looking at buying a house in the near future, let me tell you, it's really hard to save up enough for a good down payment without FHA financing (which basically is a short term loan to you because you can't make a 20% down payment on 300 k). Really hard. I have been 'saving' for retirement since I was 21, and since I was like 2 pennies above broke when I was 21, it meant I sometimes only put $25 away every month. You have to start somewhere, and this can be a small goal for you to start working towards.

Also note, if you're extremely low income (like < 30k), the government will actually help kick into your Roth IRA (look up Saver's Tax Credit). It's up to $2000... so it might be worth looking into.

Last thing - a lot of Millennials have a huge amount of student debt. That sucks, believe me I get it. However, if you invest in the stock market, you're looking at a 6-7% likely growth rate (recently 9%), whereas a lot of student loans are at 3-4%. If your loans are a higher interest rate, pay that off first. If they are lower... think about splitting your reserves between a Roth IRA (so you have something to fall back on) and your loans. Once again... compound interest (check out this calculator: You could be rich! ). You have a lot to gain from 'saving for retirement' (re: safety, house down payment, compound tax-free interest, etc.).

OK, enough with this informative message! If you want to get started with a Roth IRA, I recommend Vanguard (which I use) but I have also heard positive things about Fidelity and Black Rock. Feel free to shoot me a message if you have more questions... if there's a lot I might do a FAQ. Good luck everyone!! Start somewhere and aim high!

4 Comments